Contact details

Phone No: +91 98248 84900

Email Id: info@amlindia.in

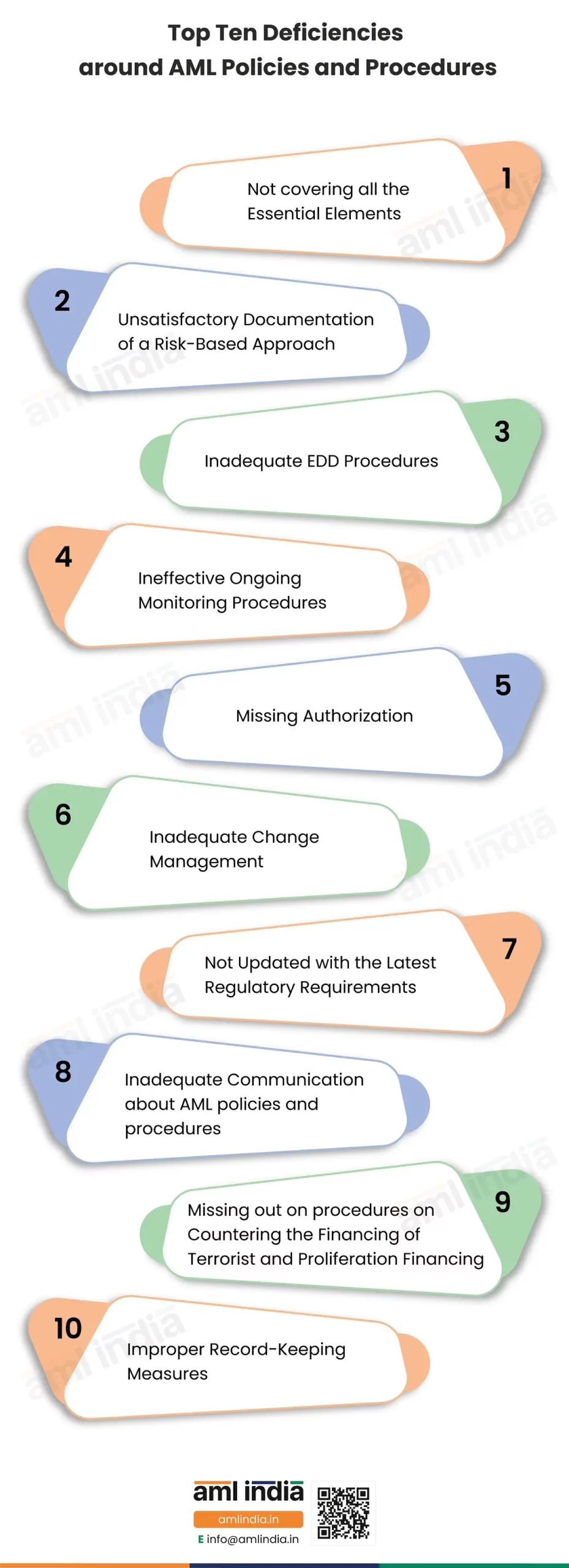

Top 10 Deficiencies around AML Policies and Procedures

Top 10 Deficiencies around AML Policies and Procedures

Prevention of Money Laundering Act, 2002 (PMLA) mandates that regulated entities, such as Financial Institutions (FIs), Designated Non-Financial Businesses and Professions and Virtual Digital Asset Service Providers, must develop and implement adequate AML policies and procedures.

AML policies and procedures direct AML compliance activities and help businesses mitigate money laundering and financial crime risks.

However, while creating these policies and procedures, you need to be cautious about the common deficiencies. These errors can cause gaps in your AML compliance program, reducing its effectiveness and leading to noncompliance.

That’s why we bring you this infographic to familiarise you with common flaws you must avoid.

Not Covering All the Essential Elements

While creating AML policies and procedures, there are several elements that must be included. For instance, enterprise-wide risk assessment, customer due diligence, ongoing monitoring of transactions, reporting, etc. Missing out on any of the essential elements leaves that aspect unguarded and may affect the related areas as well.

Inadequate Documentation of a Risk-Based Approach

Inadequate EDD Procedures

Inadequately defining enhanced due diligence procedure will make a business vulnerable to exploitation by high-risk customers. Therefore, the AML policy must cover all the high-risk customers and provide relevant measures to be applied for managing the increased risk and help conclude whether you can establish a business relationship. Moreover, the conclusion must align with the organisation’s risk appetite. Thus, the EDD process must adequately fit into the overall gambit of the AML policies and procedures.

Inadequate Ongoing Monitoring Procedures

Missing Authorization

The Principal Officer must develop AML policies and procedures. However, it is important to get senior management’s support and authorisation on the developed AML policies and procedures before implementing them. Missing authorisation means missing out on the support from the management, adversely affecting the compliance culture. Thus, the authorization and involvement from the senior management serve as an additional check that can help you make the AML policies and procedures even more effective.

Inadequate Change Management

Whenever there’s a change in the business’s attributes, such as risk appetite, customer base, etc., and you don’t align the AML policies and procedures accordingly, it will keep room for money laundering and terrorist financing crimes. Therefore, the AML policies and procedures must provide for adequately managing the changes in the business, risk factors, etc., impacting the business’s vulnerabilities to financial crimes. Only with adequate change management, where the policy changes come into effect immediately with an updated risk environment, can the business effectively combat the emerging threats.

Not Updated with the Latest Regulatory Requirements

As the risk typologies evolve, the AML laws in India keep updating, and if your AML policies don’t align with the latest regulatory requirements, they will no longer be effective. Therefore, the business must adopt the practice of updating policies immediately as soon as there’s a change in regulatory requirements. The outdated policies affect the efficacy of the risk mitigation measures and end up in non-compliance penalties.

Inadequate Communication about AML policies and procedures

For the organization-wide implementation of effective policies, adequate knowledge and engagement of the team are a must. Everyone, from front-line staff to senior management, should know AML policies and procedures in detail. When you create a policy and procedure or change them but don’t inform the relevant people, then the implementation of the latest and enhanced policies and procedures is very remote.

Missing out on procedures on Countering the Financing of Terrorist and Proliferation Financing

Generally, when discussing AML, CPF and CFT are to be considered to create a foolproof shield for the business against financial crimes. Reporting Entities create robust anti-money laundering policies and procedures but forget to include measures to mitigate terrorist financing and proliferation financing. Because of that, they are unable to achieve 100% regulatory compliance and end up getting exploited.

Improper Record-Keeping Measures

It is not done if it is not adequately recorded. If the AML policy doesn’t provide for maintaining various AML records in an organised manner for a specified period, the entire AML compliance function is a failure. The policy should explain how records, such as those related to business risk assessment, financial transactions, customer due diligence, etc., must be maintained.

Check whether these deficiencies exist in your organisation’s AML policy and procedures. In case you find any of these flaws, work to remove them and implement robust AML policies and procedures.

Important Links

subscribe to newsletter

© AML India 2023 All Rights Reserved.