Contact details

Phone No: +91 98248 84900

Email Id: info@amlindia.in

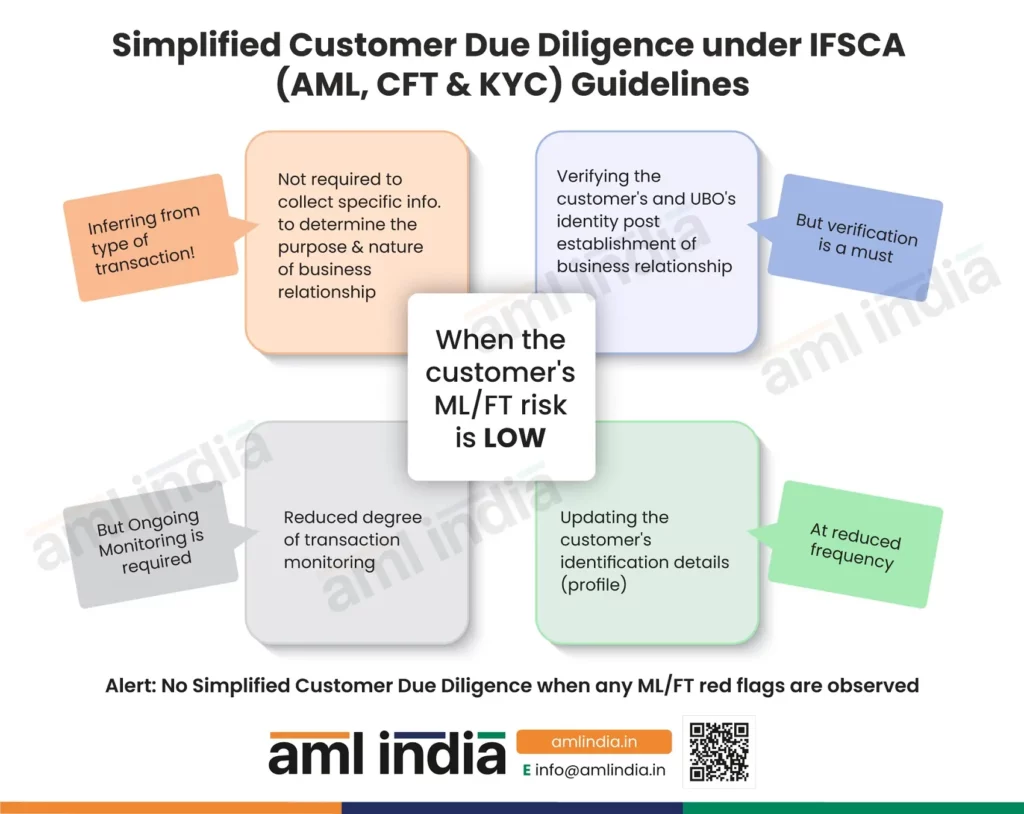

Simplified Customer Due Diligence under IFSCA (AML, CFT & KYC) Guidelines

Simplified Customer Due Diligence under IFSCA (AML, CFT & KYC) Guidelines

The IFSCA (AML, CFT, and KYC) Guidelines, 2022, permits the regulated entities to apply Simplified Customer Due Diligence when the assessed risk posed by a particular customer is “low”. This Simplified Due Diligence aligns with the AML/CFT Program’s core concept – Risk-Based Approach.

Simplified Due Diligence does not mean that no risk mitigation measures are required. Instead, certain checks and measures should be applied to adequately manage the risk – though “low”.

Here is an infographic discussing the key measures prescribed under IFSCA (AML, CFT, and KYC) Guidelines to be adopted when following the SDD, which includes:

- The regulated entities are not required to specifically enquire or seek additional details from the customer to determine the nature and purpose of the business relationship. The entities may infer the same based on the type of transaction executed by the customer.

- There is relaxation around the timing of verification measures. For a low-risk customer, the regulated entities may carry out the identity verification of the customer and the beneficial owners after the business relationship is established. However, it is to be ensured that the verification is satisfactorily concluded and that, too, before executing any transaction in such a business relationship.

- The degree of the transaction monitoring of such customers may not necessarily be as stringent as that adopted for high-risk customers.

- Regarding reviewing the customer’s profile or updating the Customer Due Diligence information, the regulated entities can do it at a reduced frequency (like once every five years).

It is important to note that the regulated entities must not apply Simplified Due Diligence when any suspicious activity or ML/FT red flags have been observed while onboarding the customer or in the course of the business relationship. This is necessary to safeguard the business and stay IFSCA compliant.

Let AML India be your AML consultant to help you explore the IFSCA (AML, CFT, and KYC) Guidelines and develop a robust AML framework to ensure adherence to the regulatory landscape and protect the business against potential financial crime vulnerabilities.

Important Links

subscribe to newsletter