Contact details

Phone No: +91 98248 84900

Email Id: info@amlindia.in

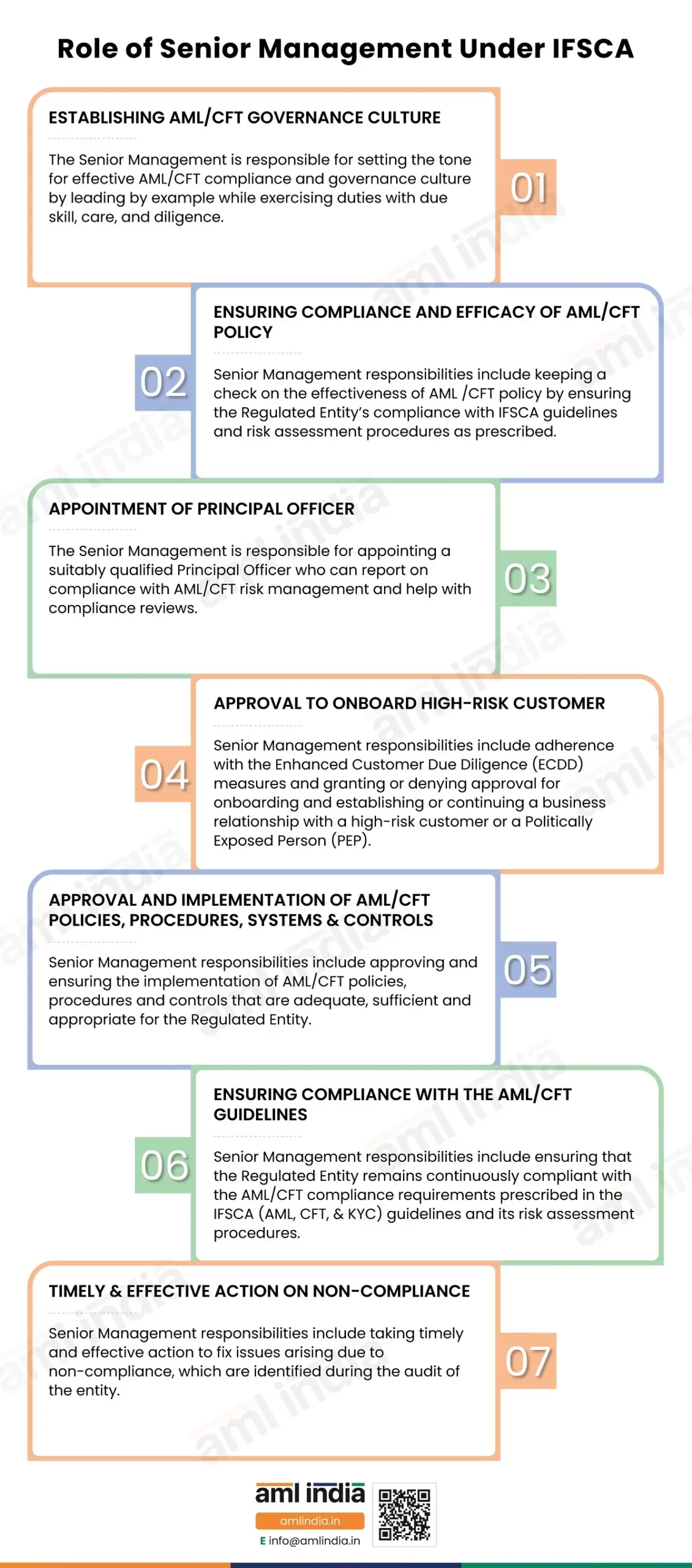

Role of senior management under IFSCA

Role of senior management under IFSCA

The entities licensed to operate within the International Financial Services Centre- IFSC Gift City are known as Regulated Entities. These Regulated Entities are required to develop, implement, monitor, and review their Anti-Money Laundering (AML)/ Counter Financing of Terrorism (CFT) policies, procedures, and controls by means of setting up a stringent AML/CFT program.

Senior Management plays a vital role in determining the level of effectiveness of the AML/CFT program as they have the approving and reviewing authority along with the necessary know-how and control within the organization to effect necessary change. The senior management of the IFSCA-regulated entities carries the following responsibilities:

ESTABLISHING AML/CFT GOVERNANCE CULTURE

The Senior Management is responsible for setting the tone for effective AML/CFT compliance and governance culture by leading by example while exercising duties with due skill, care, and diligence.

ENSURING COMPLIANCE AND EFFICACY OF AML/CFT POLICY

Senior Management responsibilities include keeping a check on the effectiveness of AML /CFT policy by ensuring the Regulated Entity’s compliance with IFSCA guidelines and risk assessment procedures as prescribed.

APPOINTMENT OF PRINCIPAL OFFICER

The Senior Management is responsible for appointing a suitably qualified Principal Officer who can report on compliance with AML/CFT risk management and help with compliance reviews.

APPROVAL TO ONBOARD HIGH-RISK CUSTOMER

Senior Management responsibilities include adherence with the Enhanced Customer Due Diligence (ECDD) measures and granting or denying approval for onboarding and establishing or continuing a business relationship with a high-risk customer or a Politically Exposed Person (PEP).

APPROVAL AND IMPLEMENTATION OF AML/CFT POLICIES, PROCEDURES, SYSTEMS & CONTROLS

Senior Management responsibilities include approving and ensuring the implementation of AML/CFT policies, procedures and controls that are adequate, sufficient and appropriate for the Regulated Entity.

ENSURING COMPLIANCE WITH THE AML/CFT GUIDELINES

Senior Management responsibilities include ensuring that the Regulated Entity remains continuously compliant with the AML/CFT compliance requirements prescribed in the IFSCA (AML, CFT, & KYC) guidelines and its risk assessment procedures.

TIMELY & EFFECTIVE ACTION ON NON-COMPLIANCE

Senior Management responsibilities include taking timely and effective action to fix issues arising due to non-compliance, which are identified during the audit of the entity.

Important Links

subscribe to newsletter