Navigating the AML Regulatory Framework in India

The crime of money laundering poses a significant threat to the integrity of the economy in India. To promote a healthy and safe business environment that is free of financial crime, India recognises the significance of combating illicit financial activities. To achieve this goal, India has adopted a robust framework of regulations and enforcement mechanisms to prevent money laundering and financial crimes within its borders. Businesses operating in India are required to develop a sound understanding of the AML regulatory framework, enabling compliance with the applicable AML laws and sector-specific guidelines.

Additionally, various supervisory authorities have issued guidelines laying down the best practices necessary to identify financial crime instances and mitigate the risks.

Applicability of AML Law in India

The entities which are subject to AML laws in India are generally referred to as “reporting entities” or “regulated entities”. According to the Prevention of Money Laundering Act, 2002 (PMLA), a reporting entity includes a banking company, financial institution, intermediary or a person carrying on a designated business or profession.

Further, the PMLA also defines persons carrying on a designated business or profession. DNFBPs encompass individuals and entities operating as:

- Casinos

- Real estate agents

- Dealers in precious metals and stones

- Individuals who manage cash and securities for others

- And any other entities designated by the Central Government through official notification

Recently, the scope of such DNFBPs has been extended to bring the following professionals under India’s AML regulatory framework, when carrying out specified activities in the course of the profession for or on behalf of its clients:

- Chartered Accountants

- Company Secretaries

- Cost and Management Accountants

Moreover, the Ministry of Finance, exercising its power under PMLA, extended the compliance requirements provided in the PMLA to the Virtual Digital Assets Service Providers (VDA SPs).

Individuals and entities involved in the abovementioned businesses and professions need to ensure compliance with PMLA.

Why is it important for businesses to be aware of India’s AML regulatory framework?

The aforementioned businesses in India need to understand the AML regulatory framework so their business practice is aligned with the regulatory framework, making efforts to combat the potential financial crime risk to which their business is vulnerable. Here is a list of a few important reasons why businesses in India should be aware of India’s AML regulatory framework:

Establish adequate internal AML compliance and governance structure

Having developed a sound understanding of India’s AML regulatory framework helps businesses formulate AML policies, procedures and controls, which enables its customer-facing personnel to detect and report suspicious activity related to financial crimes.

In order to have AML policies that are aligned with regulations and ensure better implementation of the same for preventing financial crimes.

the rigorous knowledge of AML regulatory framework helps businesses to know what to include in their AML policy to seamlessly integrate it in the operations, how frequently to update the policy and when to audit such AML policy.

Preserve its financial integrity

Knowledge and awareness about AML regulations help businesses maintain financial integrity and implement mitigating measures against financial crimes. Additionally, comprehending the framework governing compliance helps businesses understand what compliance requirements they are supposed to implement.

Knowledge of AML regulations guards financial integrity, helps monitor financial transactions and restrain the business from being exploited by the criminals, and mitigate regulatory risks, and maintain trust with regulators and other stakeholders. This definitely safeguards business reputation in the marketplace.

Avoid non-compliance with AML laws and avoid fines, penalties and reputational loss

Understanding the AML regulatory framework helps businesses to know about penalties, fines and criminal charges they may face in case of non-compliance. The imposition of penalties not only leads to financial loss but also demeans the business’s reputation, which leads to business loss and hampers business relationships.

With a grasp of the regulatory framework, businesses could maintain compliance requirements and demonstrate their commitment to fighting global vices, which would help them to avoid penalties and maintain their reputation.

Implement AML solutions, tools and technologies tailored to suit the business

Implementation of AML tools, software and appropriate technologies makes AML compliance efficient and easy. An AML program includes procedures designed to guard against someone using business for the facilitation of financial crime. With knowledge of the regulatory framework, a business can implement the best AML solutions, which are programmed in such a way that incorporate various compliance aspects in its functions such as name screening tools help with sanctions compliance.

When tools come with integration features, then various operational functions such as customer onboarding can be integrated with name screening, KYC, customer due diligence process to help businesses automate their processes and optimize the use of the resources. Additionally, with the implementation of AML solutions that are aligned with the regulatory framework, businesses can improve their efficiency and keep a better check on business activities against potential ML/FT risks.

Foster a culture of compliance and appropriate allocation of business resources

A clear understanding of the regulatory framework helps businesses comply with regulations efficiently and thus makes business compliance-focused.

A compliance-focused culture flows from the top management or the senior management of the business. The businesses in India need to have in place adequate personnel training programs to ensure that right from top management, the AML compliance team and customer-facing team are appropriately trained with regard to the potential ML, FT and PF red flags and fulfil the responsibilities of identifying and reporting suspicious transactions to the FIU.

Therefore, businesses should be aware of regulations to foster a compliance-focused culture, which contributes to a positive societal impact. Additionally, businesses with knowledge about regulations know where the risk lies and what resources are required to manage the risks. Thus, they are better at allocating business resources.

Ease in expanding business globally

Knowledge about regulatory frameworks helps enhance overall business performance. Given the global nature of financial crime risks, the awareness and compliance with AML regulations help in growth and create long-term opportunities worldwide.

Businesses that have a better understanding of global AML compliance standards perform better and grow with partnerships and collaborations. Even at a global level, an AML compliance-oriented business gets easy access to markets and country entry, which helps in the expansion of business.

Principal Statutory Regulations for AML in India

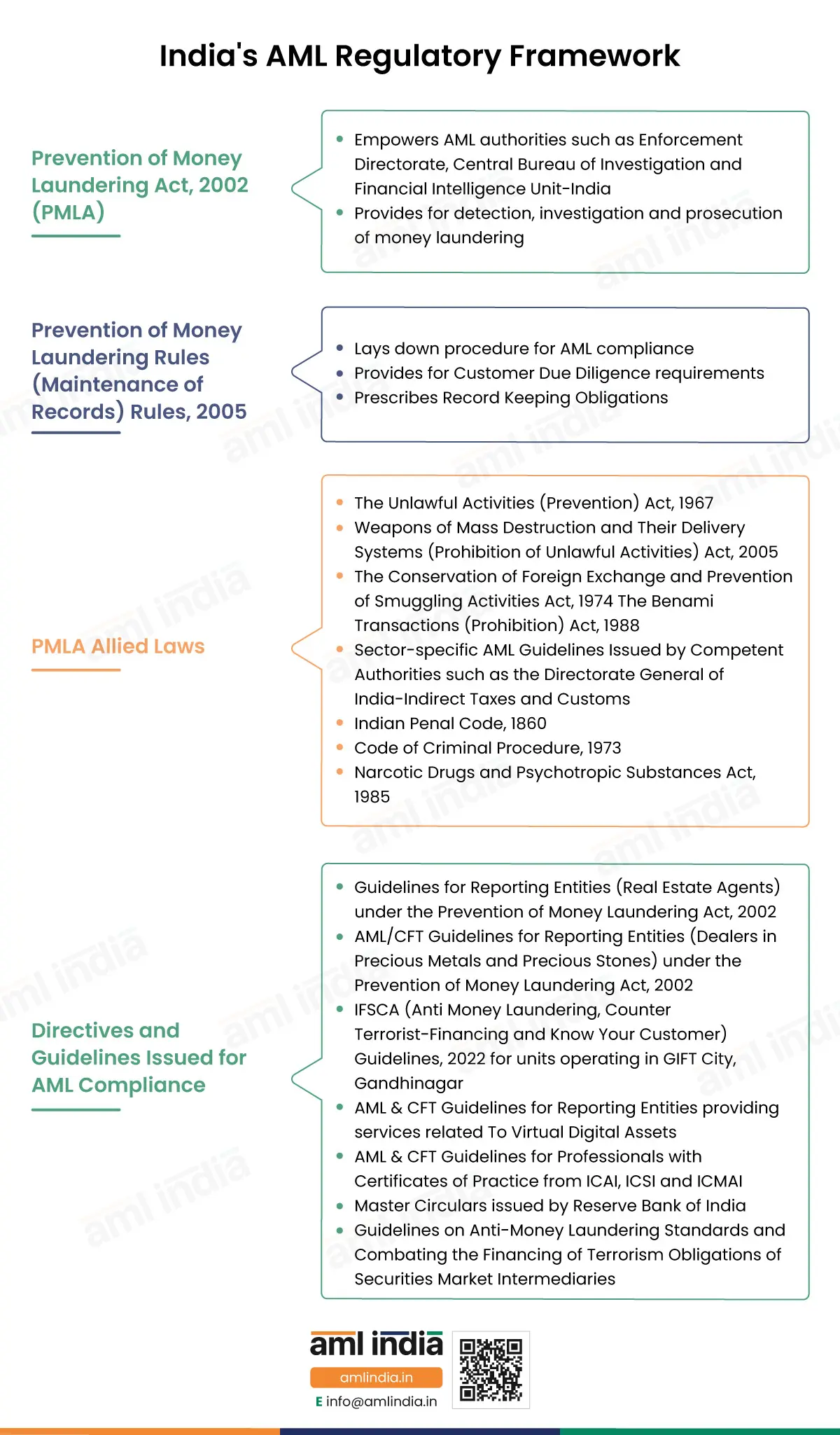

Prevention of Money Laundering Act (PMLA) of 2002

The Prevention of Money Laundering Act, 2002 (PMLA) is the primary law that governs AML/CFT regulations and guidelines in India.

The PMLA contains comprehensive provisions to combat money laundering (ML), financing of terrorism (FT) and proliferation financing of weapons of mass destruction (PF), which include empowering various relevant authorities such as the Enforcement Directorate (ED), Central Bureau of Investigation (CBI), or Financial Intelligence Unit – India (FIU–IND) to detect, investigate, and prosecute money laundering offences in a timely and effective manner.

The amendments introduced in the PMLA must be considered. With frequent advancements in the financial market and technology across various sectors, new threats of potential ML/FT and PF have developed.

Accordingly, the PMLA has undergone various amendments from time-to-time to address emerging ML/FT and PF risks and ensure continuous alignment with international standards and recommendations issued by the Financial Action Task Force (FATF).

The timely amendments to the PMLA have ensured its relevance and effectiveness in combating evolving financial crimes.

Prevention of Money Laundering Rules (Maintenance of Records) Rules, 2005

Complementing the PMLA, the Prevention of Money Laundering Rules (Maintenance of Records) Rules, 2005 (PMLA Rules) is another allied regulations brought into force to enable the prohibition of money laundering activities in India. The PMLA Rules provide operational guidelines for implementing the provisions of the PMLA.

These rules lay down procedures for anti-money laundering compliance, including customer due diligence, record-keeping, and reporting of suspicious transactions.

PMLA Allied Laws

- The Unlawful Activities (Prevention) Act, 1967

- Weapons of Mass Destruction and Their Delivery Systems (Prohibition of Unlawful Activities) Act, 2005

- The Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974 The Benami Transactions (Prohibition) Act, 1988

- Sector-specific AML Guidelines Issued by Competent Authorities such as the Directorate General of India-Indirect Taxes and Customs

- The Indian Penal Code, 1860

- Code of Criminal Procedure, 1973

- The Narcotic Drugs and Psychotropic Substances Act, 1985

Directives and Guidelines Issued for AML Compliance

In addition to the principal legislations, the various governing authorities have also released specified guidelines for different categories of reporting entities according to the nature of their activities. Some of these guidelines include:

- Guidelines for Reporting Entities (Real Estate Agents) under the Prevention of Money Laundering Act, 2002 (Guidelines for Real Estate Agents)

- AML/CFT Guidelines for Reporting Entities (Dealers in Precious Metals and Precious Stones) under the Prevention of Money Laundering Act, 2002 (Guidelines for DPMPS)

- IFSCA (Anti Money Laundering, Counter Terrorist-Financing and Know Your Customer) Guidelines, 2022 for units operating in GIFT City, Gandhinagar

- AML & CFT Guidelines for Reporting Entities providing services related To Virtual Digital Assets

- AML & CFT Guidelines for Professionals with Certificates of Practice from ICAI, ICSI and ICMAI

- Master Circulars issued by Reserve Bank of India

- Guidelines on Anti-Money Laundering Standards and Combating the Financing of Terrorism Obligations of Securities Market Intermediaries

Regulatory Authorities Overlooking AML Laws

Various regulatory authorities in India are responsible for providing frameworks to combat ML/FT. Provided below is the list of authorities working to combat financial crimes:

Ministry of Finance

The Ministry of Finance is the primary regulatory authority in India, which looks after the financial system, including AML/CFT. Within its body, the Department of Revenue is responsible for drafting laws, policies and guidelines for various financial systems, including the framework for AML/CFT laws.

Additionally, the Ministry of Finance works in collaboration with other authorities in India by providing directions to ensure that the financial system in India follows AML regulations.

Reserve Bank of India

The Reserve Bank of India, which is the central bank of the country, plays a crucial role by providing consultancy to the central government in prescribing the procedure for maintaining and furnishing information by the reporting entity for compliance with the provisions of the PMLA.

The RBI has also released comprehensive guidelines on Know Your Customer (KYC) and related compliances, to assist the financial institutions in effectively combating financial crimes.

Security Exchange Board of India

The Security Exchange Board of India (SEBI) is the central authority for the securities market in India. It monitors the stock market to prevent money laundering and financial crimes in the securities market.

SEBI has released “Guidelines on Anti-Money Laundering Standards and Combating the Financing of Terrorism /Obligations of Securities Market Intermediaries”, as mentioned above, which details the various AML measures the security market players have to adhere to protecting the integrity of the India’s securities market.

Insurance Regulatory and Development Authority of India

The Insurance Regulatory and Development Authority of India (IRDAI) is a regulatory body for the insurance industry in India. It makes sure that insurance companies implement measures for AML/CFT.

In the context, IRDAI also releases details guidelines on AML/CFT compliance for insurance companies and agents operating in India.

International Financial Services Centres Authority

The International Financial Service Centre (IFSC) is set up to develop India as a global investors’ hub. With IFSC entities’ global exposure in terms of business activities and customers, the risk of financial crime becomes more worrisome.

Strong AML program implementation in IFSC entities must be ensured to overcome this risk. To safeguard the business and the economy against ML/FT vulnerabilities, the IFSCA releases AML/CFT regulations and ensures that regulated entities adhere to them.

AML Enforcement through Specialized Agencies

Various agencies have been constituted in India to prevent money laundering and terrorism financing. Following is the list of agencies working towards the prevention of financial crimes:

Enforcement Directorate

The Enforcement Directorate (ED) is a financial investigation agency under the Ministry of Finance. It investigates offences relating to money laundering and violations of foreign exchange laws and is responsible for the enforcement of provisions laid down under the PMLA.

Financial Intelligent Unit India (FIU-IND)

The Financial Intelligence Unit is a national agency that receives, processes and analyses suspicious financial transactions in India. Just like the ED’s role, the PMLA 2005 has conferred power on FIU-IND to implement the provisions of the Act. All regulated entities, for the purpose of compliance with PMLA, are required to furnish information to FIU-IND to prevent financial crimes in the country.

Cooperation with International Agencies for Combating Financial Crimes

With the advancement in technology and globalisation, there has been a rise in cross-border financial transactions. Thus, international agencies are working with the country to limit cross-border money laundering and terrorism financing.

It is important for businesses involved in export-import or cross-border trade to have relevant knowledge of these regulatory frameworks for compliance measures in combating money laundering and terrorism financing.

Knowledge of these international regulations helps businesses involved in international trade safeguard the integrity of financial transactions, protect the business against criminal activities, and preserve the security of the global financial system.

One such international agency working with India for AML/CFT is FATF.

The Financial Action Task Force (FATF) sets international standards and recommendations for combating money laundering, terrorist financing, and other financial crimes. India became a member of the FATF in 2010 to implement a more advanced regulatory system for AML/CFT.

As a member, India implements these recommendations and cooperates with FATF and other member countries to combat money laundering and related crimes effectively. Businesses in India, when implementing AML policies, procedures, and controls, need to adopt a risk-based approach, including other recommendations by FATF, such as compliance with Targeted Financial Sanctions (TFS), reporting to FIU, etc. to ensure that its AML compliance measures are at par with FATF standards that are globally recognised.

Let’s safeguard India with thorough understanding of AML regulatory framework!

Awareness and compliance with India’s AML regulatory framework are imperative for businesses operating in India. In order to combat ML/FT, businesses in India have to adopt an effective anti-money laundering policy through collaboration and cooperation among different authorities and agencies. With such stringent regulations, guidelines, and measures, India aims to prevent money laundering activities, protect the integrity of its financial system, and contribute to global efforts to combat money laundering and terrorism financing.

Therefore, AML compliance not only safeguards businesses from legal and reputational risks but also acts as a guardian for financial integrity and maintaining accountability in the financial ecosystem.

FAQs on AML Regulatory Framework in India

The Prevention of Money Laundering Act 2002, along with the Prevention of Money Laundering Rules 2005, which were issued under it, form the primary framework for the anti-money laundering laws in India.

Multiple authorities oversee AML enforcement in India. However, the Enforcement Directorate under the Department of Revenue, Ministry of Finance and FIU-IND under the Ministry of Finance are responsible for enforcing the provisions of PMLA 2002.

PMLA 2002 applies to all persons and covers individuals, companies, firms, an association of persons or a body of individuals working as a banking company, financial institution, intermediary or a person carrying on a designated business or profession.

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti is a Chartered Accountant and Certified Anti-Money Laundering Specialist (CAMS) with over 7 years of experience in regulatory compliance, policymaking, risk management, RegTech solution consultancy, and implementation. With an understanding of the different jurisdictional AML regulations, including PMLA, 2002 and IFSCA (AML, CFT, and KYC) Guidelines, has been closely working with clients to implement Anti-Money Laundering measures, including conducting Enterprise-Wide Risk Assessments, imparting AML training, etc.