Uncovering the ML/FT Red Flag Indicators for IFSCA-regulated entities

The regulated entities operating from the GIFT City must follow the IFSCA (Anti-Money Laundering, Counter Terrorist-Financing and Know Your Customer) guidelines, 2022. Chapter X of the Guideline deals with identifying suspicious transactions, and Section 10.2 (a) provides a detailed guidance note on red flags or suspicious indicators concerning a customer or a transaction. This article deals with the Money Laundering (ML) and Financing of Terrorism (FT) red flag indicators for IFSCA-regulated Entities.

What is ML/FT?

It is best to define ML/FT Risk Appetite as the amount and type of risk an entity is willing to take on in pursuit of its goals and objectives.

Definition of Money Laundering

Money Laundering is the process of hiding the proceeds of a criminal activity.

Definition of Terrorism Financing

Terrorism Financing is the process of raising and processing funds to support terrorists and their terrorist activities.

What is termed as Red Flags?

Red Flags are indicators that can help identify underlying illegal activities like money laundering or terrorism financing. Red Flags are also known as Suspicion Indicators. They are warning signs for businesses to remain alert for potential money laundering and terrorist financing activities.

Importance of understanding the ML/FT Red flags for IFSCA-Regulated Entities

The knowledge and understanding of ML/FT red flags can save regulated entities from being used as a conduit for money laundering or terrorist financing. The customer-facing staff must know the suspicion indicators, and if they observe any red flags, they must bring such customers to the principal officer’s notice. The back-office staff ensuring compliance and transaction monitoring should know the potential warning signals for ML/TF to counter such activities.

Taking Consultation is

Better than Taking Risks

Let AML India be Your Side to Mitigate ML/TF Threats

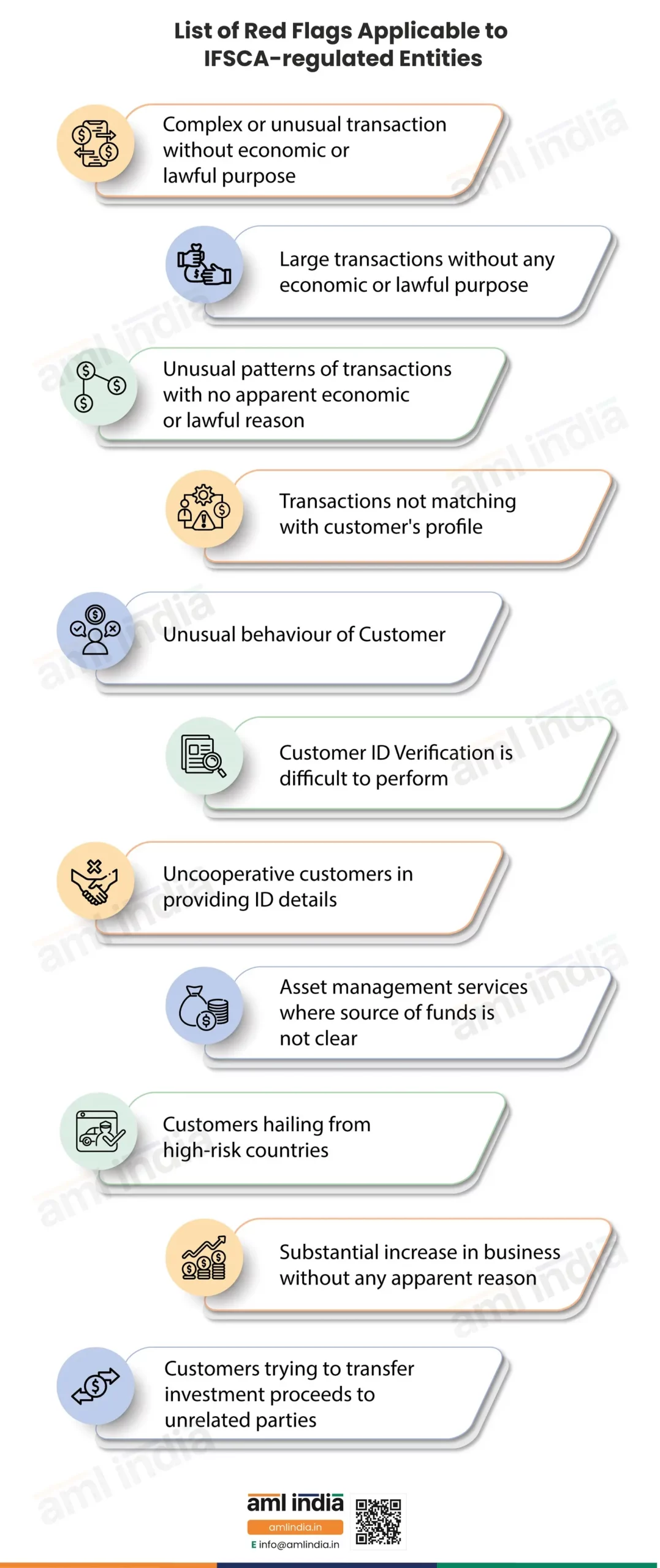

List of Red Flags Applicable to IFSCA-regulated Entities

- Complex transactions and unusual transactions with no apparent business or lawful purpose

- Large transactions with no apparent business or lawful purpose

- Unusual patterns of transactions with no apparent business or lawful purpose

- The transaction does not match the customer’s profile regarding background, type, source of funds, etc.

- Customers behaving unusually

- Customers where their ID verification is difficult to perform

- Uncooperative customers when asked about their ID Verification, KYC, etc.

- Asset management services where customers do not have a clear source of funds, or it does not align with their business activity

- Customers hailing from high-risk jurisdictions

- Substantial increase in business without any apparent reason

- Customers who tried to transfer investment proceeds to apparently unrelated parties

Connection between red flags and AML/CFT compliance

Red flag indicators help comply with the AML/CFT regulations. The regulated entities must submit a Suspicious Transaction Report (STR) with the FIU, India when they suspect ML/TF.

However, the entities must ensure the confidentiality of the STR and should not tip off the reported customer.

The regulated entities are also expected to keep customer information up-to-date. After observing any suspicion, the entity must check the customer’s business profile, transaction history, customer risk profile, income level, source of income at the time of onboarding, reasons behind conducting a transaction, beneficiary, transaction frequency, transaction size, complexity of transaction, geographies involved, availability of KYC and other documents. Once the regulated entity checks it, it should evaluate if there are any changes in the risks associated with the customer in light of the updated information.

The AML/CFT compliance obligations require entities to state the reasons behind a suspicion clearly, and if they can not establish reasonable grounds behind the suspicion, they must keep monitoring the customer and underlying business relationship.

Further, as per the IFSCA (AML/CFT and KYC) Guidelines, the STR requirement applies to all suspicious transactions, irrespective of the amount. There is no monetary threshold defined for submitting STR.

If the regulated entity fails to obtain customer identification documents, the regulated entity should not enter into a business relationship unless directed in writing by the FIU-IND.

If the customer refuses to provide customer identification documents and the regulated entity finds such a customer suspicious, the attempted transaction must be reported to FIU-IND as a suspicious transaction.

Lawyers, notaries, and accountants are required to submit suspicious transactions when they engage in a financial transaction on behalf of the client for buying and selling real estate, managing client money, security or other assets, management of bank, savings or securities accounts, organisation of contributions for the creation, operation, or management of companies, and creation, operation or management of legal persons or arrangements, and buying and selling of business entities.

FAQs on ML/FT Red Flag Indicators for IFSCA-regulated entities

As far as the red flags are concerned, some of them are commonly applicable to all entities, and some vary according to the nature of the reporting entities’ business.

Red flags are generally classified into customers, products/services/transactions, delivery channels, geography, technology, etc.

Yes, a transaction could have more than one red flag indicator.

Suppose a reporting entity identifies red flags in relation to a customer or transaction. In that case, it should try to gather as much information as possible without informing the suspicion to the customer and try to rule out the possibility of ML/TF. If the suspicion persists, it should file a Suspicious Transaction Report with the FIU-IND.

Yes, if the customer refuses to provide proof of ID, it’s a red flag, and such non-cooperative customers must be reported to the FIU in the form of an STR.

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.