A Guide for Entities Subject to FIU-IND Reporting on FINGate 2.0 Portal

The regulated entities in India are under legal obligation to submit various reports to the Financial Intelligence Unit, India (FIU-IND). The Guide for Entities Subject to FIU-IND Reporting on FINGate 2.0 Portal deals with such regulated entities and the reports they should submit to the FIU-India.

What is FIU-IND?

FIU-IND stands for the Financial Intelligence Unit of India, the central national agency for collecting intelligence related to potential financial crime-related transactions in India. It functions solely to safeguard India’s financial system from the adverse impact of money laundering, terrorist financing, and other economic crimes.

What is the role of FIU-Ind?

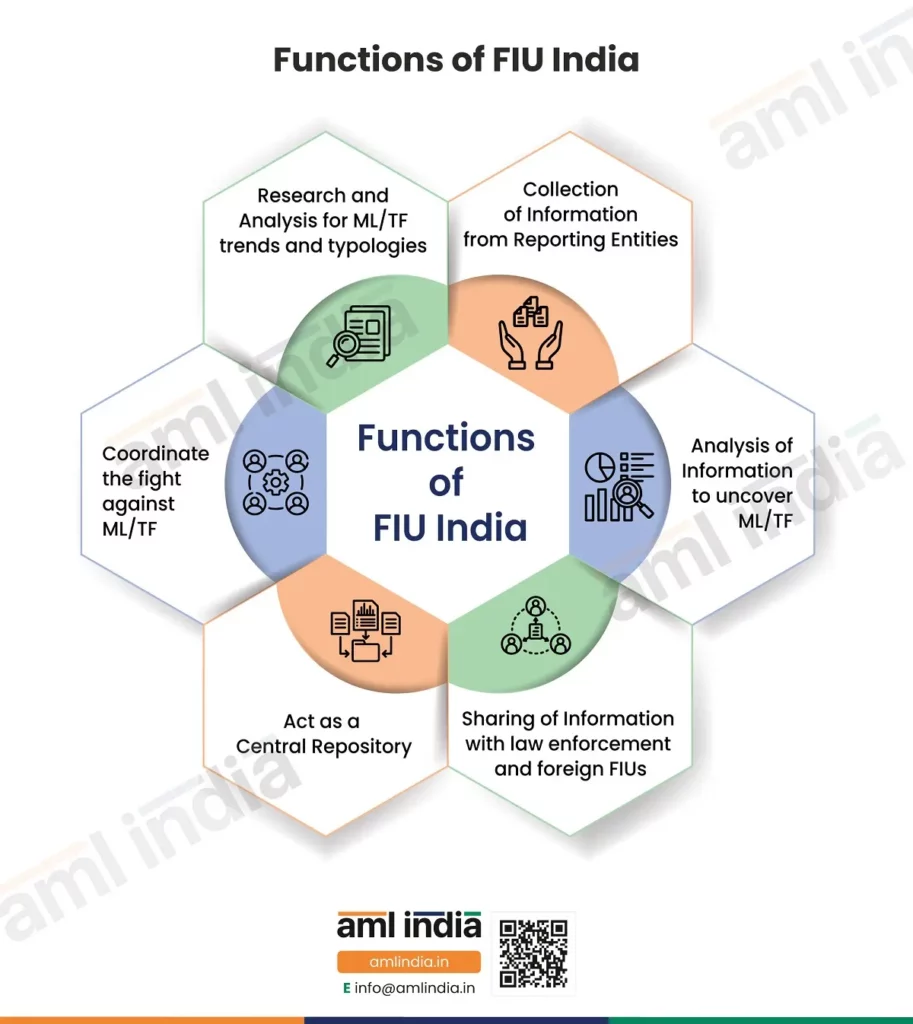

The core functions of FIU-IND include:

- Collection of Information from Reporting Entities

- Analysis of Information to uncover ML/TF

- Sharing of Information with law enforcement and foreign FIUs

- Act as a Central Repository

- Coordinate the fight against ML/TF

- Research and Analysis for ML/TF trends and typologies

What is FIU-IND Reporting?

FIU-IND Reporting refers to the process of passing the information and data by various entities registered under various laws, which have direct and indirect potential of being abused or exploited by money launderers or other financial criminals.

FIU-IND has set up the framework which is also known as FIU 2.0 for reporting to monitor and ensure that there are resilient and productive AML/CFT processes and controls that prevent, deter, and detect any misuse or abuse of the Indian Financial System.

What is FINNet 2.0?

FINNet 2.0 stands for Financial Intelligence Network 2.0, an upgraded version of FINNet 1.0, the primary platform within the reporting framework set up by FIU-IND.

FINNet 2.0 enables a robust platform that validates the data filed by the reporting entities with the support of external data sources. It also prioritises and identifies cases from reports using risk analytics.

The primary characteristics of FINNET 2.0 are as follows:

- The backend functionality of FINNet 2.0 is based on advanced intelligence and Machine Learning Algorithms put forth with Natural Language Processing (NLP) and Application Processing Interface (API), creating a self-evolving ecosystem.

- The front end of the reporting framework under FINNet 2.0 is FINGate 2.0, a web-based portal developed for reporting suspicious financial transactions and other information related to potential money laundering and financing of terrorism activities.

- The FINGate portal application is as handy as a mobile application for quick accessibility.

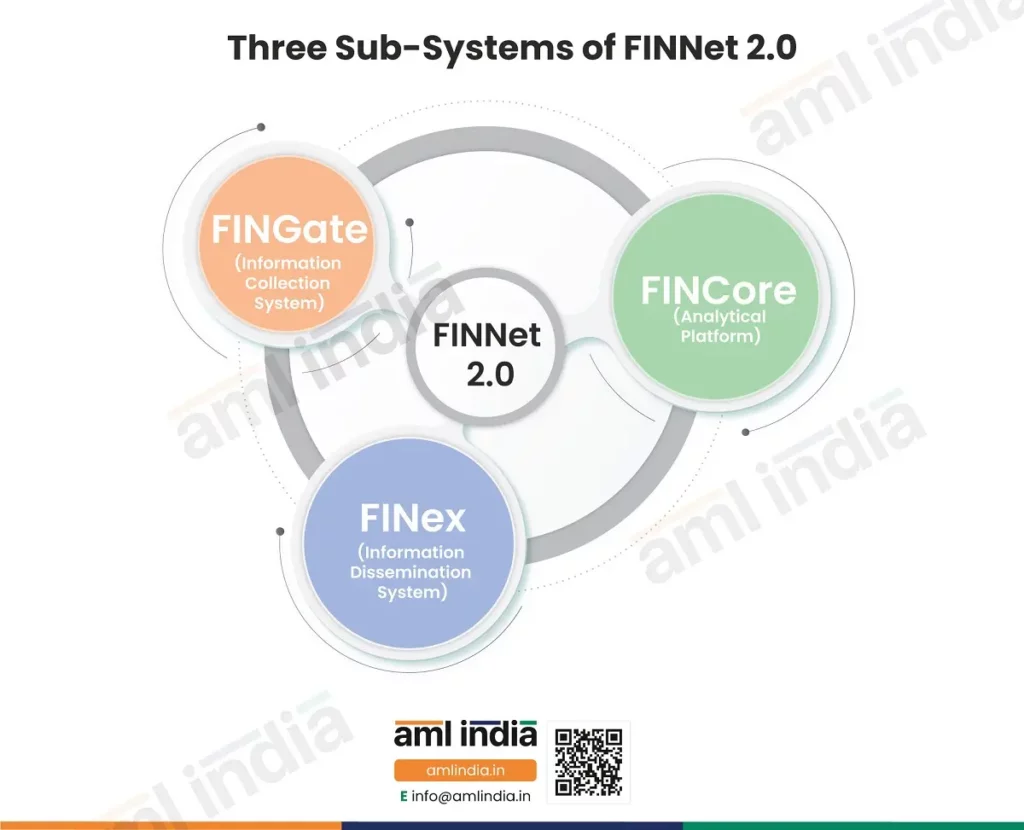

The FINNet 2.0 comprises three sub-systems: FINGate, FINCore, and FINex:

what is FINGate 2.0 System?

FINGate 2.0 system is a portal maintained by the FIU-Ind. Reporting entities in India are required to file necessary reports using the FINGate 2.0 system. The REs must register on FINGate 2.0 to fulfil their FIU reporting obligations in India.

Who is required to submit reports on the FINGate 2.0 Portal?

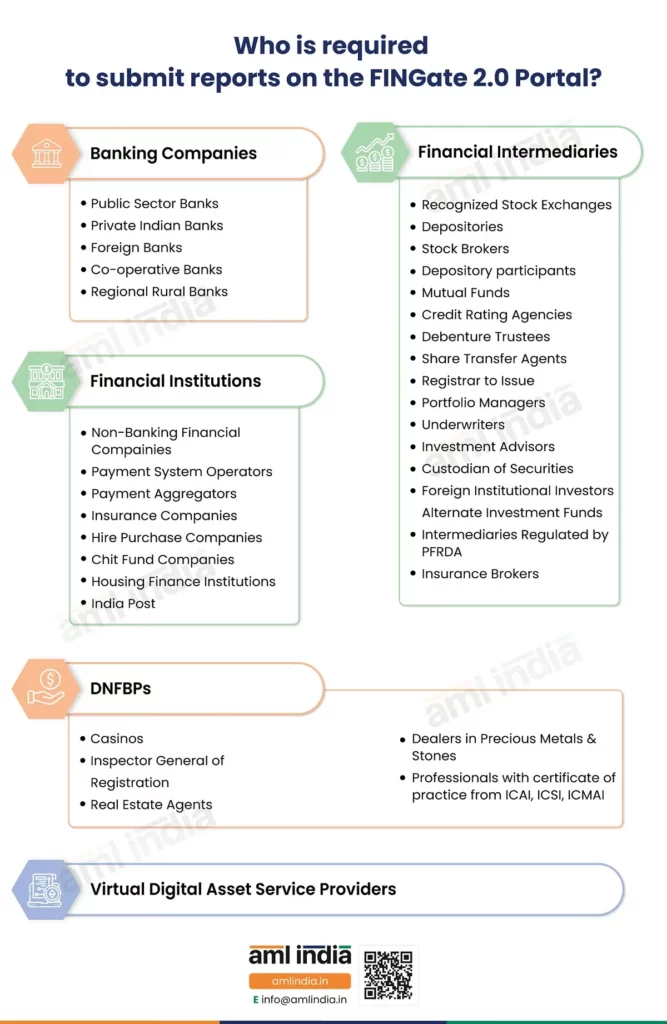

Broadly, the entities listed below under Financial Sector & Designated Non-Financial Businesses and Professions must submit reports on the FINGate 2.0 Portal. The entities must undergo FINGate 2.0 login procedures and security mechansim before filing reports with the FINGate portal.

Banking Companies

Banking Companies being Public Sector, Private Indian, and Foreign Banks, Cooperative & Regional Rural Banks

Financial Service Institutions

Financial Service Institutions include Non-Banking Financial Companies, Payment system operators, Payment aggregators, Hire Purchase, Chit Funds, Housing Finance, India Post, Insurance Companies, etc.

Financial Intermediaries

Financial Intermediaries such as Recognised Stock Exchange, Depositories, Stock Brokers, Depository Participants, Mutual Funds, Credit Rating Agencies, Debenture Trustees, Share Transfer Agents, Registrar to Issue, Portfolio Managers, Underwriters, Investment Advisors, Custodian of Securities, Foreign Institutional Investors, Alternate Investment Funds, Intermediaries regulated by Pension Fund Regulatory and Development Authority (PFRDA), Insurance Brokers.

Designated Non-Financial Businesses and Professions (DNFBPs)

Designated Non-Financial Businesses and Professions (DNFBPs) include entities such as Casinos, Inspector General of Registration, Real Estate Agents, Dealers in Precious Metal and Stones, Professionals with a Certificate of Practice from the Institute of Chartered Accountants of India (ICAI), Institute of Company Secretary of India (ICSI), Institute of Cost Accountants of India (ICMAI).

Virtual Digital Assets Service Providers

Virtual Digital Assets Service Providers (VASPs or VDA SPs) engaged in virtual digital assets related activities in the course of business

Apart from the above, the internal offices of FIU-IND and the other government agencies also need to file reports with the FIU-India.

Types of reports to be submitted to FIU-IND on the FINGate 2.0 Portal

The reports submitted to FIU-IND on the FINGate 2.0 portal are the primary source of information that is further analysed and enriched with another information source to produce actionable financial intelligence for initiating investigations or developing evidence. The FIU-IND, on average, receives more than 30 lakh reports every month, as per the FIU-IND’s Annual Report for the year 2022-23.

The reporting requirements to FIU-IND are broadly identified based on the nature of the service provided. There is a FINGate 2.0 user manual available on the FIU website, helping entities follow the prescribed procedures.

FIU-IND Reporting by Banks on FINGate 2.0 Portal

Banks play a crucial role in the economy & they are more prone to Money Laundering and Terrorist Financing risks. Banks carry various products and deal with cash, so they must be more careful about financial crimes. Consequently, activities must be continuously monitored and analysed; the indicative list of reports the bank needs to submit are:

- Cash Transaction Report (CTR) for banks

- Suspicious Transaction Report (STR) for banks

- Cross Border Wire Transfer Report (CBWTR) for banks

- Counterfeit Currency Report (CCR) for banks

- Non-Profit Organisation Transaction Report (NTR) for banks

FIU-IND Reporting by Insurance Companies on FINGate 2.0 Portal

The usage of insurance products for ML/TF is a known typology. Criminals take advantage of insurance products, pay premiums in cash and then terminate the insurance policy just before the end of the pre-look period. They get the entire proceeds in their bank account, which is how they place money into the legitimate economy. The PMLA mandates the insurance companies to submit various reports, including,

- Cash Transaction Report Type (CTR) for insurance

- Counterfeit Currency Report (CCR) for insurance

- Cross Border Wire Transfer Report (CBWTR) for insurance

- Non-Profit Organisation Transaction Report (NTR) for insurance

- Suspicious Transaction Reports (STR) for insurance

FIU-IND Reporting by Department of Posts on FINGate 2.0 Portal

India Post provides postal services throughout India. It also vested its presence in the banking industry by offering financial products that are easily accessible. However, easy access was due to the low level of diligence involved, making it more vulnerable to ML/FT. An indicative list of reports submitted by Post are:

- Cash Transaction Report (CTR) for the Department of Post

- Suspicious Transaction Report (STR) for the Department of Post

- Counterfeit Currency Report (CCR) for the Department of Post

- Non-Profit Organisation Transaction Report (NTR) for the Department of Post

- Cross Border Wire Transfer Report (CBWTR) for the Department of Post

FIU-IND Reporting by Mutual Funds on FINGate 2.0 Portal

A mutual fund is a pool of money collected from many investors and invested in various assets like stocks, bonds, and money market instruments. Like any other financial institution, mutual funds are susceptible to the risk of ML/FT. Thus, the reporting frame needs to imbibe the effect of the risk involved. Mutual Funds are required to submit the following reports to the FIU-India:

- Cross Border Wire Transfer Reports (CBWTR) for Mutual Fund

- Suspicious Transaction Report (STR) for Mutual Fund

- Non-Profit Organisation Transaction Report (NTR) for Mutual Fund

FIU-IND Reporting by Card System Operators on FINGate 2.0 Portal

Card System Operators (CSOs) play a crucial role in the financial industry, managing the infrastructure and operations behind various types of payment cards. It inadvertently plays a role in money laundering due to inherent vulnerabilities and weaknesses within the complex payment system. An indicative list of reports submitted by Card System Operators are:

- Suspicious Transaction Report (STR) for Card System Operators

- Cross Border Wire Transfer Report (CBTR) for Card System Operators

- Cash Transaction Report (CTR) for Card System Operators

FIU-IND Reporting by Casinos on FINGate 2.0 Portal

A casino, in general, is a facility for certain types of gambling, typically offering games of chance. It’s a cash-intensive business vulnerable to money laundering and terrorist financing. The reporting practice needs to be stringent for such a nature of business. An indicative list of reports submitted by Casino are:

- Suspicious Transaction Report (STR) for Casino

- Cross Border Wire Transfer Report (CBTR) for Casino

- Cash Transaction Report (CTR) for Casino

FIU-IND Reporting by Real Estate Agents on FINGate 2.0 Portal

Real Estate Agents (REAs) are the persons or entities who arrange real estate transactions, bringing buyers and sellers together and representing them in negotiation. These REAs are critical in their involvement in property transactions, which are generally high-value transactions. An indicative list of reports submitted by Real Estate are:

- Suspicious Transaction Report (STR) for Real Estate Agents

- Cash Transaction Report (CTR) for Real Estate Agents

- Counterfeit Currency Report (CCR) for Real Estate Agents

FIU-IND Reporting by Brokerage Firms on FINGate 2.0 Portal

Brokerage firms are the intermediaries between their clients and the stock exchange, where the products in question, be stocks, mutual funds, bonds, or even commodities, are included in the list. Thus, the reports submitted by such firms are imperative. An Indicative list of reports that a brokerage firm files are:

- Suspicious Transaction Report (STR) for Brokerage Firms

- Non-Profit Organisation Transaction Report (NTR) for Brokerage Firms

FIU-IND Reporting by Money Transfer Services on FINGate 2.0 Portal

Money Transfer Services (MTSS) are intermediaries that facilitate the movement of funds from one individual or entity to another, often across geographical boundaries. The very nature of the transaction is prone to exploitation by criminals for money laundering due to its speed and flexibility. The reporting of these money transfer agents plays a crucial role in safeguarding the motive of FIU-IND. An indicative list of reports submitted by Money Transfer Services are:

- Cash Transaction Report (CTR) for MTSS

- Suspicious Transaction Report (STR) for MTSS

FIU-IND Reporting by FI/NBFC/Others on FINGate 2.0 Portal

Apart from a bank and other similar institutes listed, any other entities with similar services, being a non-banking financial company or else involved, need to report their transaction under the framework set up by FIU-IND. An indicative list of reports submitted by FI/NBFC/Others are:

- Cash Transaction Report (CTR) for FI/NFBC/Others

- Suspicious Transaction Report (STR) for FI/NFBC/Others

FIU-IND Reporting by Property Registrar on FINGate 2.0 Portal

The Property Registrar is the authority registering and administering the property title, including transfer, lease, etc. Thus, a Property Registrar’s Office does play a vital role in combating MF/FT by being vigilant in the process & reporting the information to FIU-IND. An indicative list of reports submitted by the Property Registrar are:

- Property Transaction Report (PTR) for Property Registrar

- Suspicious Transaction Report (STR) for Property Registrar

FIU-IND Reporting by Exchange Houses on FINGate 2.0 Portal

Exchange houses are businesses that exchange foreign currency for one or more currencies. The access to local and foreign currency makes it more vulnerable to the risk of ML/FT. The indicative reports Exchange Houses are required to file are:

- Suspicious Transaction Report (STR) for Exchange Houses

FIU-IND Reporting by Depositories on FINGate 2.0 Portal

The depositories are the financial institutions that hold and maintain securities (such as stocks, bonds, and mutual funds) in electronic form on behalf of investors. NSDL & CDSL are the primary depositories in India. They are also required to report to FIU-IND transactions that impinge India’s financial system, directly or indirectly. An indicative list of reports a depository is required to file is:

- Suspicious Transaction Report (STR) for Depositories

FIU-IND Reporting by Payment Aggregators and Payment Gateways on FINGate 2.0 Portal

Payment Aggregators and Payment Gateways have a far-reaching impact on the financial system because of their ease of accessibility. An indicative list of reports submitted by Payment Aggregators and Payment Gateways are:

- Suspicious Transaction Report (STR) for Payment Aggregators

FIU-IND Reporting by Dealer in Precious Metals and Stones on FINGate 2.0 Portal

The dealers in Precious Metals and Stones (“PMS”) are persons or entities that buy or sell precious metals, stones, or jewellery. The PMS industry can be an easy target for money laundering because of its ease of carry and drop. An indicative list of reports submitted by dealers in Precious Metals and Stones are:

- Suspicious Transaction Report (STR) for Dealer in Precious Metals and Stones

FIU-IND Reporting by Virtual Digital Assets Service Provider on FINGate 2.0 Portal

In broader terms, Virtual Digital Assets Service Providers (VASP) perform exchanges between virtual assets and fiat currencies or between different virtual assets. These VASPs are entities without central regulating authority to control and monitor the transactions. Thus making it pivotal that dealings on such platforms are governed. An indicative list of reports to be submitted in FIU-IND are:

- Suspicious Transaction Report (STR) for Virtual Digital Asset Service Provider

FINGate Helpdesk

In case the reporting entities face any difficulties in FINGate Registration or FINNet Registration, they can contact helpdesk. The FINnet Helpdesk details are as follows:

FINGate Helpdesk Email: helpdesk-re@fiuindia.gov.in

FINGate Helpdesk Phone: 011-23463691, 011-23463692, 011-23463693

Conclusion

The reporting requirements are largely indicative based on the nature of the transaction, products or services, and the parties involved. Also, there can be varying cases where certain reports need to be filed because of the nature of the service and the type of entity. Like for example, a banking company also providing brokerage firm service for stocks or mutual funds needs to comply with the reporting requirement of both services based on transaction type, and so on.

FAQs on FIU-IND Reporting on FINGate 2.0 Portal

The indicative list of reports to be submitted to FIU-IND are:

- Cash Transaction Report Type (CTR)

- Counterfeit Currency Transaction Report (CCR)

- Cross Border Wire Transfer Report (CBWTR)

- Non-Profit Organization Transaction Report (NTR)

- Property Transaction Report (PTR)

- Suspicious Transaction Report (STR)

Every transaction in which the reporting entity has suspicion needs to be reported to FIU. Further, FIU also provides a the list of indicative transactions that need to be reported even if suspicious doesn’t exist. This list is based on the threshold value of the transaction depending upon the nature & parties involved in the transaction. Also, in certain cases, transactions must be reported because the product’s value exceeds the threshold limit.

The monetary limit for reporting Cash Transactions is more than 10 lakh or the equivalent value of the foreign currency, which could be a single transaction or a series of transactions integrally linked to each other that have happened within 1 month.

In the case of the Property Transaction Report, every purchase and sale by any person of immovable property valued at 50 lakh rupees or more must be reported.

The cross-border wire transfers of more than five lakh rupees or its equivalent in foreign currency where the fund’s origin or destination is in India need to be reported in a Cross Border Wire Transfer Report (CBWTR).

For a Non-Profit Organization, all transactions involving receipts of value more than rupees ten lakh, or its equivalent in foreign currency, need to be reported in a Non-Profit Organization Transaction Report (NTR)

The Suspicious Transaction Report (STR) should be furnished immediately once the entity is satisfied that the transaction is suspicious.

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.