Documents Required for Identity Verification of the Legal Person under IFSCA (AML/CFT and KYC) Guidelines, 2022

Documents Required for Identity Verification of the Legal Person under IFSCA (AML/CFT and KYC) Guidelines, 2022

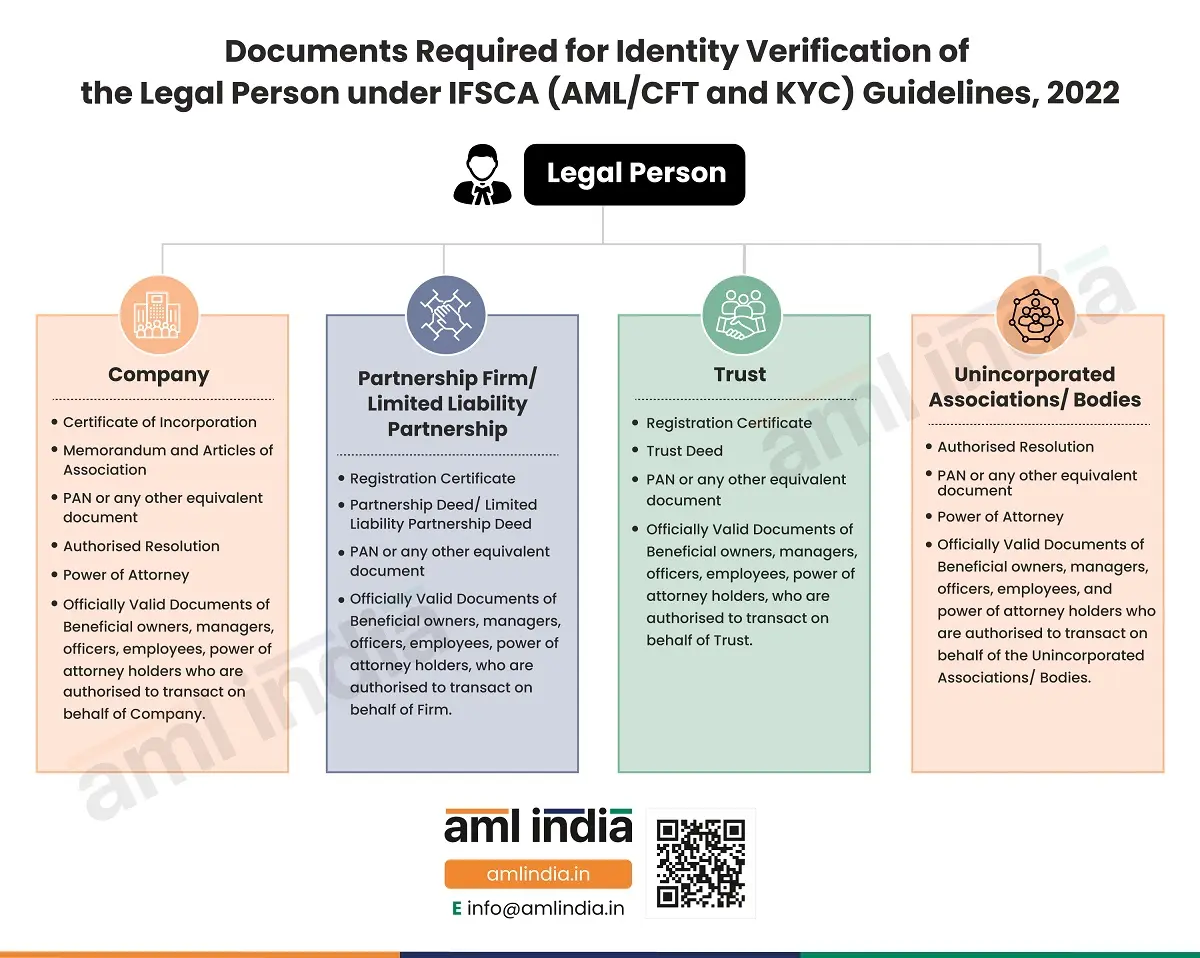

The International Financial Services Centres Authority (AML, CFT, and KYC) Guidelines, 2022, has recommended the list of documents to be obtained for verification of the identity of the legal entity.

Customer due diligence is a crucial part of AML/CFT compliance, and customer ID verification is one of its essential elements. It’s a known typology to carry out transactions without revealing the true identity of the ultimate beneficiary.

It is essential to obtain the prescribed documents to perform Customer Due Diligence. Information requirements differ for different legal entities such as companies, partnership firms/limited liability partnerships, trusts, and unincorporated associations/bodies.

In the case of a legal entity, the identity of the ultimate beneficial owner also needs to be verified before executing or establishing any transaction with the legal entity.

Check the above-added infographic capturing the documents to be obtained for verification of the legal entity.

Important Links

subscribe to newsletter