Contact details

Phone No: +91 98248 84900

Email Id: info@amlindia.in

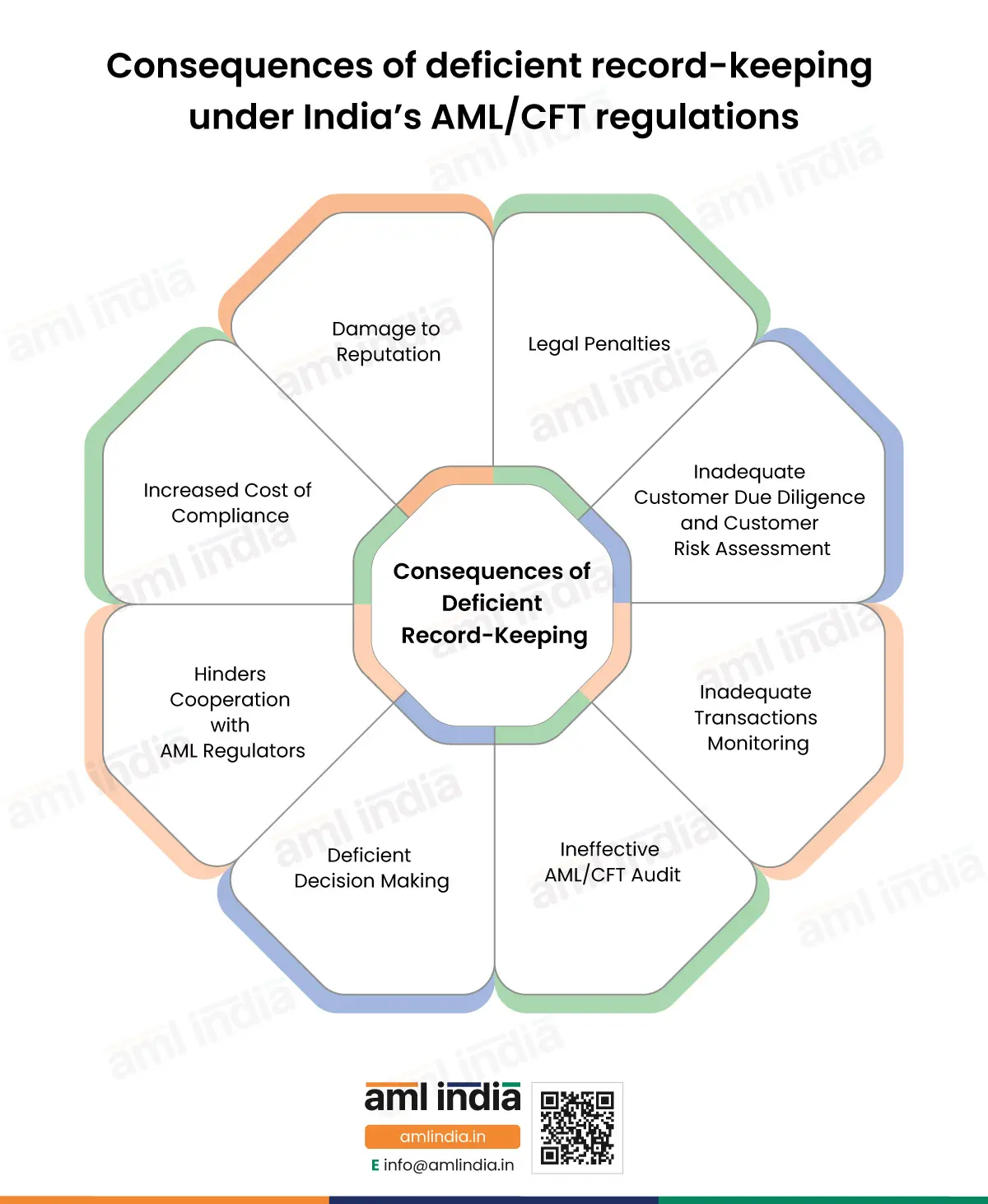

Consequences of Deficient Record-Keeping Under India’s AML/CFT Regulations

Consequences of Deficient Record-Keeping Under India’s AML/CFT Regulations

As an integral part of Anti-Money Laundering / Countering the Financing of Terrorism (AML/CFT) compliance requirements in India, record-keeping provides protection against money laundering (ML), terrorism financing (TF) and proliferation financing (PF) risks.

This is because record–keeping enables proactive monitoring of transactions and customer behaviour, informed decision–making related to ML, TF and PF risks, efficient AML/CFT auditing and comprehensive customer due diligence (CDD). Given its importance, deficient record–keeping can lead to severe consequences.

This infographic discusses these consequences to emphasise the significance of record–keeping as a part of AML/CFT program of entities regulated under AML/CFT laws of India.

Legal Penalties

Legal penalties and fines are the most immediate and critical consequence of deficient record–keeping. The Prevention of Money Laundering Act 2002 mandates the maintenance of records pertaining to suspicious transactions, documents collected during the CDD and Know Your Customer (KYC) process, etc.

International Financial Service Centre Authority (IFSCA) (AML, CFT, and KYC) Guidelines, 2022 also requires entities operating in GIFT City, Gandhinagar, to keep records such as documents collected during the CDD process, records related to AML/CFT enterprise–wide risk assessment (EWRA), transactions, etc. Non-compliance with these requirements results in penalties. Therefore, ensuring effective record-keeping is of utmost importance to avoid penalties.

Inadequate Customer Due Diligence and Customer Risk Assessment

Record keeping enables verification of the identity documents of the customer, as well as tracking the changes in customer profile and the ML, TF or PF risks associated with the customer over time. This, in turn, allows for customer risk assessment (CRA). Without adequate record keeping, both CDD and CRA become difficult to implement.

Inadequate Transactions Monitoring

Record–keeping of transaction details is necessary to detect and report suspicious transactions that may indicate ML, TF or PF risks. Without record–keeping, this analysis of transactions is difficult.

Ineffective AML/CFT Audit

Audits and health checks of the AML/CFT program of a business can only be effective and comprehensive if they take into account and examine the various documents and information collected during the CDD, CRA, EWRA, etc. Poor record keeping impairs the auditing process and makes it difficult to assess the efficacy of the AML/CFT program of the entity.

Deficient Decision Making

Good and informed decision-making comes from analysing past records and data. To take a call on ML, TF or PF risks, record keeping is therefore crucial. Deficient record–keeping results in detrimental decision–making.

Hinders Cooperation with AML Regulators

AML regulators often require information or documents as part of their investigation or compliance check process. Effective coordination with AML regulators such as the Financial Intelligence Unit-India becomes difficult with deficient record keeping. It can result in penalties as well.

Increased Cost of Compliance

When penalties are put on the entity for deficient record keeping, this increases the cost of compliance. Further, ineffective record–keeping increases the difficulties of implementing CDD, CRA, EWRA and other AML measures, increasing the cost of compliance.

Damage to Reputation

Reputation is valuable for any entity. Deficient record–keeping can lead to legal issues and penalties, resulting in a negative reputation. A bad reputation can result in a loss of customer and investor trust.

Conclusion

All these consequences discussed in this infographic emphasise the importance of proper record-keeping. Entities should adopt and maintain robust and effective record-keeping practices to avoid these consequences.

Important Links

subscribe to newsletter