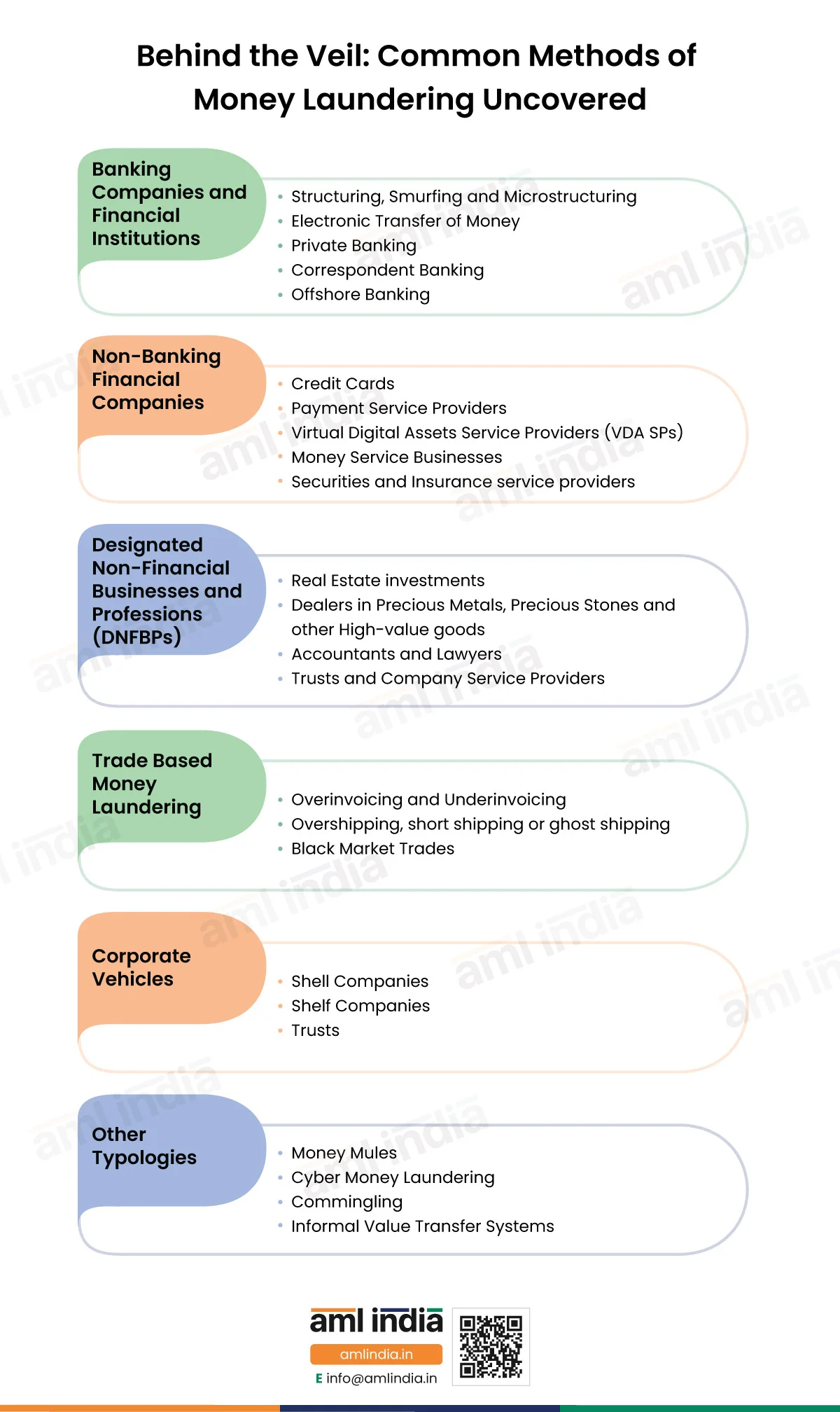

The methods used to launder money are constantly evolving with the use of technology. In India, it is necessary to keep up with the common typologies used in money laundering to develop measures for curbing them. This article uncovers the common methods and channels used by money launderers to make their illicitly gained money seem legitimate.

Money launderers exploit various channels to ‘clean’ their ‘dirty’ money. These channels are used in all three stages of money laundering, i.e., placement, layering and structuring. These channels along with the methods money launderers employ to exploit them are discussed below.

Want to ramp up your AML compliance

with crypto travel rule compliance?

Get in touch with us for AML expertise.

Banking Companies and Financial Institutions as Channels for Money Laundering

Structuring, Smurfing and Micro-structuring:

These typologies involve the breaking of large amounts of illicit funds into smaller amounts to make sure that the funds don’t appear to be suspicious.

- In structuring, after breaking the funds into smaller amounts, the funds are then placed in different bank accounts to avoid detection.

- In smurfing, multiple individuals or ‘smurfs’ are deployed to deposit the broken-up funds into multiple bank accounts.

- Micro structuring is similar to structuring but done at a much smaller level, and larger funds are broken up into very small amounts.

Electronic transfer of money:

Money launderers use electronic transfer of money services to move funds between accounts, banks, and jurisdictions with the aim of creating multiple layers of transactions. This obscures the source of funds and makes detection by law enforcement difficult.

Private Banking:

Private Banks often provide specialised services to individuals with high net worth. Private banks are also known for adopting high-level of measures to ensure client confidentiality and have limited transparency provisions. This environment is exploited by money launderers as private banks may not adopt rigorous client due diligence methods due to their close and personal relations with the clients.

Correspondent Banking:

Correspondent banks act as agents of other banks located abroad and provide correspondent banking services to the customers of such banks. This is done by banks when they don’t have a presence in a particular jurisdiction but wish to provide international banking services to their clients.

The indirect nature of correspondent banking relationships implies that the bank offers services to individuals and entities relying on the due diligence performed by correspondent banks, and many times, it turns out to be non-existent or inadequate. This vulnerability is exploited by money launderers.

Offshore Banking:

Money launders often employ services of banks located abroad in jurisdictions with strict privacy laws, lax anti-money laundering regulatory regimes or tax havens.

Non-Banking Financial Companies as Channels for Money Laundering

Money Laundering through Credit Card:

Credit cards are used in the layering or integration stage of money laundering. For example, illicit funds already placed into the banking system are routed to pay for credit card services, enabling the obscuring of the source of funds. Or, after placing the illicit funds in an offshore bank with lax anti-money laundering policies, the funds are accessed through credit cards

Money Laundering through Payment Service Providers:

Third Party Payment Processors (TPPPs) offer domestic and international payment processing services to merchants and business entities. The type of merchants the TPPPs serve can significantly increase their exposure to money laundering risks. For example, TPPPs working with internet merchants may be at a high risk of money laundering due to the high susceptibility of these merchants to financial crimes.

Money Laundering through Virtual Digital Assets Service Providers (VDA SPs):

Virtual Digital Assets Service Providers (VDA SPs) such as cryptocurrencies, offer high levels of privacy and anonymity. Criminals use these platforms to convert illicit funds into cryptocurrency, which can then be laundered or spent anonymously. Similarly, virtual assets such as Non-Fungible Tokens (NFTs) are brought and traded through illicit funds to layer the laundered money.

Money Laundering through Money Service Businesses:

Money Service Businesses (MSBs) provides money transmission or conversion services. MSBs are often exploited to convert illicit funds into different currencies, further layering the transactions and complicating anti–money laundering detection.

Money Laundering through Securities or Insurance service providers:

Brokers can be used to invest illegally gained funds into securities, bonds, insurance or other financial products. These investments can then be claimed or pledged to generate legitimate returns on the funds, facilitating the layering and integration of the laundered money. Top of Form

Designated Non-Financial Businesses and Professions as Channels for Money Laundering

Real Estate:

Illegally gained money can be used to purchase real estate, which can then be resold or rented to generate seemingly legitimate income. Further, overvaluing real estate or using shell companies to make real estate purchases is used to obscure the source of the funds. Therefore, real estate agencies need to be careful and adopt AML measures to avoid these risks.

Dealers in Precious Metals, Precious Stones and other High-value goods:

In India, the high-value goods market may be exploited by money launderers to buy and resell these items, thereby disguising the source of the funds and blending them into the financial system. Therefore, for Dealers in Precious Metals and Precious Stones, adopting AML measures becomes very important.

Accountants and Lawyers:

Accounting and legal services are used to create complex financial structures or to provide legal cover for illicit transactions. They may facilitate the movement of funds or help to establish shell companies. Due to client confidentiality obligations, it may become difficult for law enforcement agencies to detect money laundering.

For more information, check out our article on common mistakes by Chartered Accountants in AML Compliance

Trusts and Company Service Providers:

Trusts and company service providers are exploited to create complex legal structures and corporate vehicles that obscure the true ownership of funds.

Join the Fight Against Money Laundering

and Terrorism Financing

Combat ML/TF Risks With AML India

Trade-Based Money Laundering

Over-invoicing and under-invoicing:

Money launderers use over–invoicing to mix legitimate and illegitimate funds. For example, they invoice for goods or services at inflated prices, allowing them to move excess funds across borders. Similarly, under–invoicing involves declaring the value of goods or services as lesser than their actual value. The objective is to transfer value to the goods seller (in over–invoicing) or the customer (in under–invoicing). In simple terms, the difference between the actual price and the altered price is used to transfer illicit money.

Over shipping, short shipping or ghost shipping:

In these typologies, the quantity of goods exported or imported is misrepresented to the authorities to move the illicit funds under the guise of import-export trade payments. Both the importer and exporter are involved in this scheme.

Black Market Trades:

Using black market trade allows money launderers to undertake transactions that are not reported to authorities and are therefore difficult to detect.

Money Laundering through Corporate Vehicles

Shell Companies:

Shell companies are set up and used to transfer and disguise the source of illicit funds. These companies have no significant business operations or assets of their own but are used to create a facade of legitimacy for transactions. These are created in tax havens and other high-risk jurisdictions with minimal anti-money laundering oversight.

Shelf Companies:

A shelf company is an already registered company that is currently inactive or “put on the shelf.” This corporation is then sold to buyers who may engage in money laundering by activating these shelf companies.

Trusts:

Arrangements of trusts are exploited to hold and manage assets while disguising their true ownership. By placing illicit funds into a trust, money launderers obscure the source of these funds and integrate it into legitimate financial structures. Since trusts are private structures, there is often less anti-money laundering scrutiny for its members.

Other Typologies

Money Mules:

Money mules are individuals that knowingly or unknowingly facilitate money laundering. They may be recruited to receive, transfer or withdraw the illicit funds through their bank accounts.

Cyber Money Laundering:

Cyber money laundering involves using digital technologies and online platforms such as the dark web markets or online black markets, to transfer illegally gained funds. Advanced technologies such as encryption, anonymisation, tumblers, etc are also used to avoid detection.

Commingling:

Commingling is the process in which illicit funds are mixed with legitimately sourced money to obscure the origin of the illegally gained funds. Commingling makes it difficult to separate and detect the laundered money from the legitimate money.

Informal Value Transfer Systems (IVTFs)

IVTFs are informal services that enable the transferring and remittance of funds through persons who receive the funds and facilitate payment of an equal value to a third party located in another country. This is a form of alternative banking system which operates underground through established networks. Examples of such systems include Hawala and Hundi. IVTFs enable money laundering by transferring illicit funds from one jurisdiction to another through underground networks.

Conclusion

The money laundering typologies described in this article explore different aspects of the financial system and various types of institutions. Understanding these methods is the first step towards designing effective anti-money laundering program, including rigorous regulatory oversight, advanced monitoring systems and reporting, and effective international cooperation.

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti is a Chartered Accountant and Certified Anti-Money Laundering Specialist (CAMS) with over 7 years of experience in regulatory compliance, policymaking, risk management, RegTech solution consultancy, and implementation. With an understanding of the different jurisdictional AML regulations, including PMLA, 2002 and IFSCA (AML, CFT, and KYC) Guidelines, has been closely working with clients to implement Anti-Money Laundering measures, including conducting Enterprise-Wide Risk Assessments, imparting AML training, etc.