Contact details

Phone No: +91 98248 84900

Email Id: info@amlindia.in

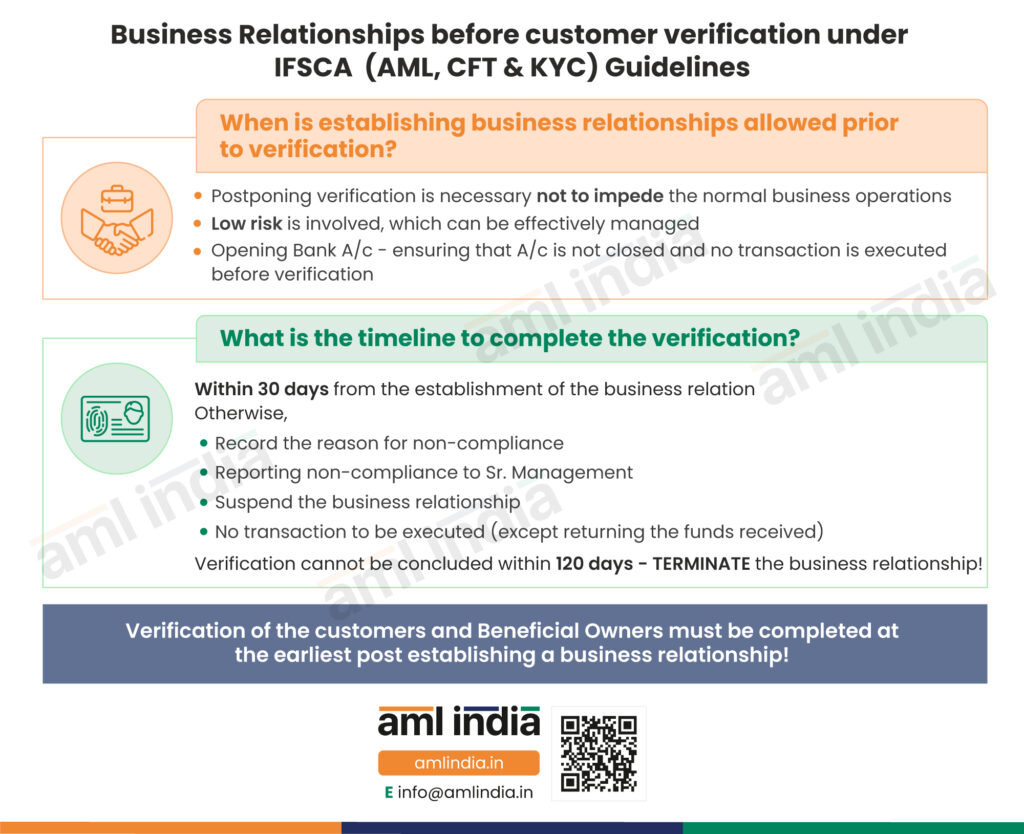

Business Relationships before customer verification under IFSCA (AML, CFT & KYC) Guidelines

Business Relationships before customer verification under IFSCA (AML, CFT & KYC) Guidelines

International Financial Services Centre Authority’s (IFSCA) AML Guidelines mandate that the regulated entities conduct customer verification before establishing a customer relationship. However, there are certain exceptions to this requirement.

However, businesses can’t postpone the verification endlessly. There’s a strict period of 30 days within which the customer’s identity must be verified. If the business fails to do so, then it must record the reason for non-compliance and report it to senior management. Further, the regulated entities must suspend the customer relationship and shall not execute any transaction except to entertain refund requests for the funds deposited earlier.

The business relationship must be terminated if the customer can’t be verified within 120 days.

AML India can surely assist you in your AML compliance journey. We will help you with AML compliance so that you focus on increasing your business growth opportunities while safeguarding your business from money laundering and financial crime risks.

Important Links

subscribe to newsletter