Contact details

Phone No: +91 98248 84900

Email Id: info@amlindia.in

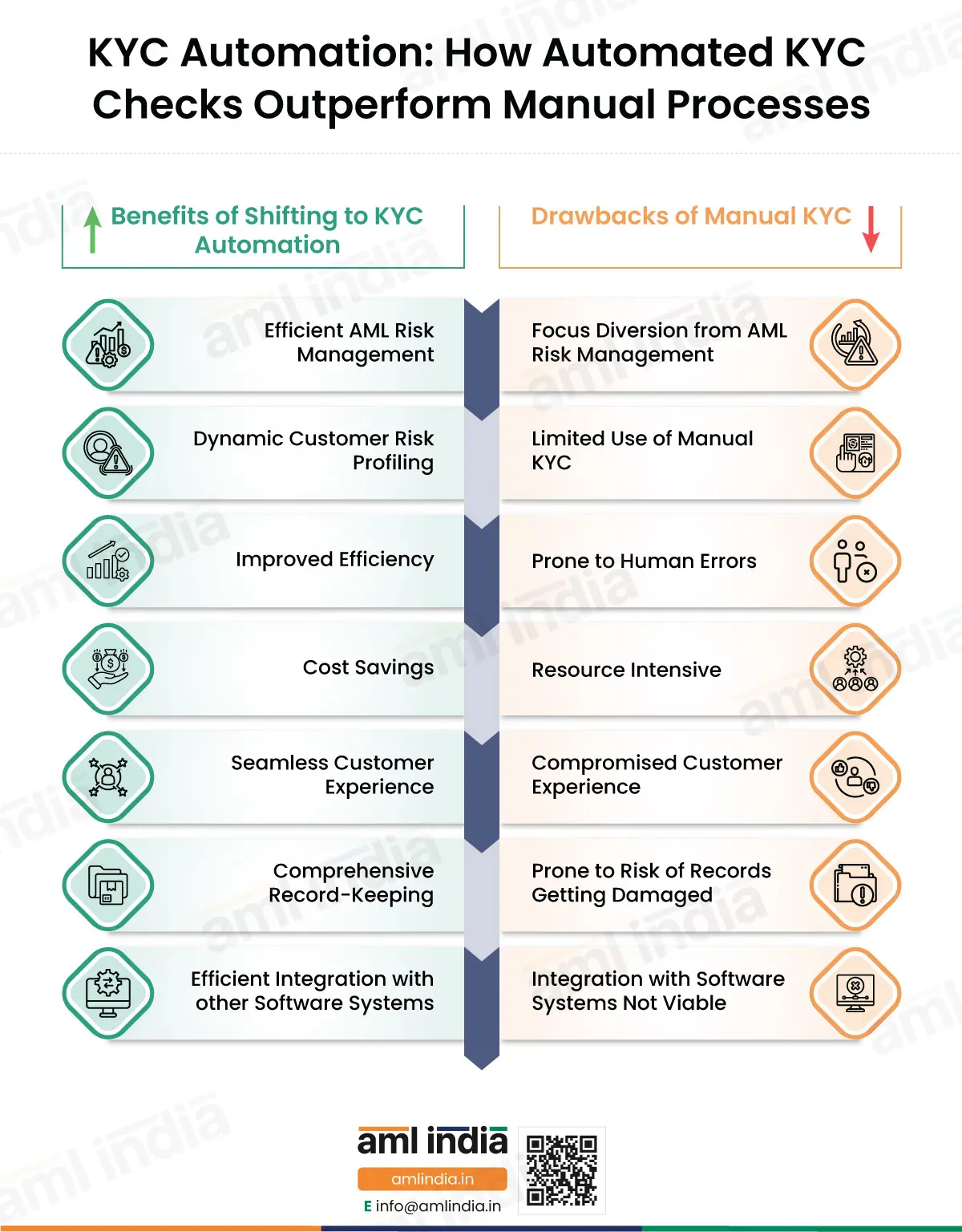

KYC Automation: How Automated KYC Checks Outperform Manual Processes

KYC Automation: How Automated KYC Checks Outperform Manual Processes

Regulated Entities in India subject to Anti-Money Laundering (AML) Compliance requirements need to carry out Customer Due Diligence (CDD) to identify and verify their customers. Conducting Know Your Customer (KYC) is an essential element of CDD process. This infographic discusses the benefits of KYC automation.

KYC process helps identify and verify customers to mitigate Money Laundering (ML) and Terrorism Financing (TF) risks effectively as it helps build customer profile essential for conducting customer risk assessment and deploying adequate due diligence measures.

The benefits of shifting from the traditional manual mode of conducting KYC to automated KYC checks are as follows:

Efficient Risk Management:

Manual handling of large volumes of customer data can be resource heavy and tiresome. It requires Regulated Entities to assign staff for customer data collection to dissemination and storage, usually diverting focus from quick onboarding to back-and-forth between customer and regulated entity to fulfil documentary requirements.

Automation of KYC helps with efficient risk management by bringing back focus to fulfilling compliance needs by speeding up the KYC process with increased accuracy and efficiency coupled with resource optimisation.

Dynamic Customer Risk Profiling:

Automation of KYC measures has a major advantage of helping with customer risk profiling as it provides access to customer data and this data contains parameters on basis of which customer profile is prepared. This helps Regulated Entities to keep a track of their customer’s data in real time helping detect changes with regard to customer information filled in the customer profile. This dynamic monitoring of customer details is a feature that only KYC automation and similar AML compliance tools can provide and which manual KYC cannot fulfil.

Improved Efficiency:

It is understood that with automated KYC, human input is greatly reduced, leading to lesser human clerical errors, increased accuracy, time saving by conducting hundreds of KYCs through a KYC tool in a minute instead of hiring staff, training them and assigning KYC work to them which could takes weeks to complete, not to mention review of such manual KYC for errors. Thus, KYC automation contributes greatly to improved efficiency.

Cost Savings:

Needless to say, lesser human input leads to lesser costs in long run as the need to hire high number of KYC analysts reduces vastly due to automation of KYC process through KYC software.

Seamless Customer Experience:

Manual KYC leads to lot of confusion and frustration on the customer as every now and then, the KYC analyst may seek additional documents or different sets or clearer copies of documents that a customer has already provided. Automated KYC helps with attachment of officially valid documents (OVD) by the customer themselves through “self-KYC” module or functionality of the KYC software, that enables customers to fill in their KYC details remotely, at any given point in time, and attach necessary documents, leading to seamless customer experience.

Comprehensive Record-Keeping:

With KYC software comes the KYC software’s ability to store and keep track of all the KYC measures, steps, processes, documents, and customer data collected. This solves the problem of manually storing hard copies of customer documents in record-rooms for years together and paying rent for such a use of space with risks of fire, flood, and theft hazards. The automated KYC also helps maintain records for a prescribed timeframe by the regulator.

Efficient Integration with other Software Systems:

Another advantage of KYC software versus manual KYC is its ability to integrate with existing and future software that a regulated entity may use for customer onboarding purposes, such as customer relationship management (CRM) software. This is a major plus ,as the ability of manual processes to integrate with any software-related process is non-existent.

Conclusion

Regulated entities in India and the IFSC Gift City must consider delegating their KYC requirements to a trusted AML KYC software solution to streamline their KYC obligations.

Ensuring adequate KYC Automation!

To make the most of your investment in AML KYC software, get the professionals to guide!

Important Links

subscribe to newsletter